Tally Payroll Part II

In Tally Payroll Tutorial - Part I we see the masters vouchers for payroll. Now we will see how to create them with a case study example:

Consider a manufacturing company the produces cloths (for example, powerlooms producing Gad cloths).

There are two kinds of employee on the company’s payroll

1. PCS Rate wages (based on the production done)

2. Daily wages (Fixed flat rate)

For example the following two employees works on PCS Rate

1. Sundar - Rs. 2.50 per Unit

2. Ponnusamy - Rs. 2.75 per Unit

The following two are paid daily

1. Karthi – Rs. 150 per day

2. Suresh – Rs. 175 per day

Now you have to create payroll for them using Tally. How can you do? It is very easy. Here are the steps you need to follow:

Firs you need to create pay heads in Payroll master.

We need two pay heads:

1. Wages Daily (For Daily Flat wage employees)

2. Wages PCS Rate (For PCS Rate employees)

Before creating Pay Head you need to create Attendance / Production Types

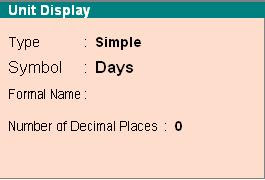

Before creating production Types you need to create work unit

Go to -> Units (Work)

Select Create

Give Symbol: Mtr (for cloths manufacturing, it depends on company)

Format Name: Meter

Number of Decimal places: 1

Give Y to Save

This is used to pay head for production based pay

Similarly create another unit with Days as symbol name

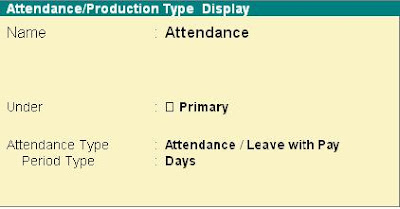

Now select 'Attendance / Production Type' under Payroll Info

Select Create

Name: Cloths produced

Under: Primary

Attendance Type: Production

Unit: Mtr

Similarly Create another with

Name: Attendance

Under: Primary

Attendance Type: Attendance / Leave with pay

Period Type: Days

Now go to pay heads

Select Create

Name: Wages by Attendance

Page Head type: Earnings for Employees

Under: Direct Expenses

Appears in pay slip: Yes

Calculation Type: On Attendance

Attendance / Leave with pay: Select ‘Attendance’ (We just created before)

Calculation Period: Days

We just created one pay head. Create another

Name: Wages by PCS Rate

Page Head type: Earnings for Employees

Under: Direct Expenses

Appears in pay slip: Yes

Calculation Type: On Production

Attendance / Leave with pay: Select ‘Cloth Produced’ (We just created before)

Now you create employees and Employee Groups

Create two employee Groups

1. Daily Wages Employees

2. PCS rate Employees

Create employees:

Karthi and Suresh in ‘Daily Wages Employee’ Group

Ponnusamy and Sundar in ‘Pcs Rate Employee’ Group

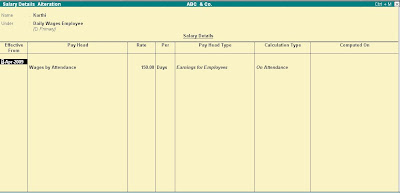

Now go to ‘Salary Details’ under Payroll Info

Select Create

Under Employee / Group select ‘Sundar’

Under pay head select ‘Wages by Pcs Rate’ and under rate give 2.50, under per give mtr

Accept and give yes

Similarly for ponnusamy give 2.75

Now select karthi and select ‘Wages by attendance’ for pay head and give 150 per day

Similarly for suresh give 175 per day

Great! You are finished with masters. Lets go to Transactions in Tally Payroll Tutorial - Part III

0 comments:

Post a Comment